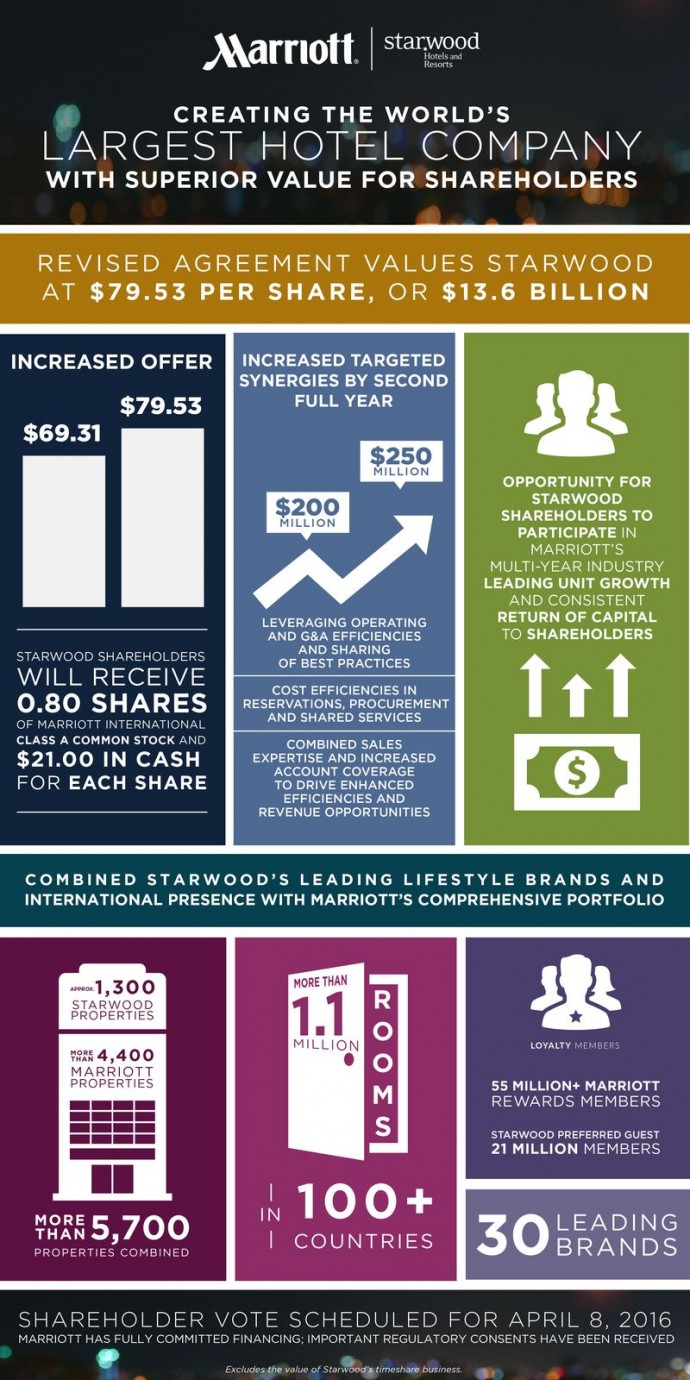

Today Marriott International turns around with a revised merger agreement with Starwood Hotels and Resorts Worldwide after Anbang consortium submitted a better offer last week. Both companies have the revised terms value Starwood at US$79.53 per share or US$13.6 billion.

The revised terms from Marriott have been deemed by Starwood’s Board of Directors as more superior to the previously announced offer by the consortium led by Anbang Insurance Group.

There is an increased cash consideration of US$21 for each share of Starwood common stock. Both Marriott and Starwood would hold special stockholder meetings on 8 April 2016 with transaction closing planned for mid 2016.

Marriott has conducted extensive due diligence and joint integration planning and is confident it can achieve US$250 million in annual cost synergies within two years after closing, up from US$200 million estimated in November last year when it announced its original merger agreement.

Marriott expects the transaction to be roughly neutral to adjusted earnings per share in 2017 and 2018. One-time transaction costs for the merger are expected to total around US$100 million to US$130 million. Transition costs are also expected to be incurred over the next two years.

The transaction is subject to stockholder approvals of both parties as well as completion of Starwood’s planned disposition of its timeshare business, obtaining remaining regulatory approvals and the satisfaction of other customary closing conditions.

The break-up fee payable by Starwood in certain circumstances has been increased from US$400 million to US$450 million. In circumstances when the termination fee is payable, Starwood would also be required to reimburse Marriott for up to US$18 million of actual costs incurred by Marriott in connection with the financing of the transaction.