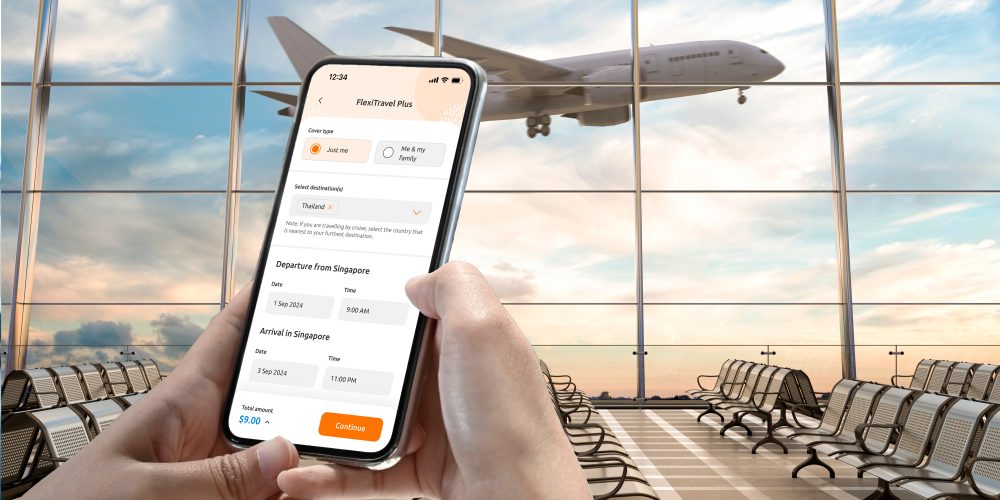

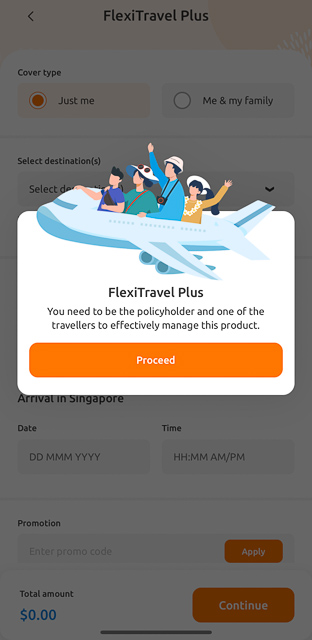

Income Insurance has introduced FlexiTravel Plus, a new travel insurance option that allows travelers to extend their coverage by the hour for trips to 19 Asian destinations through the My Income mobile app. This policy replaces the previous FlexiTravel Hourly insurance, which only covered travel to Bintan, Batam, and Malaysia.

The 19 destinations now covered include Brunei, Cambodia, Indonesia (including Batam and Bintan), Laos, Malaysia, Myanmar, the Philippines, Thailand, Vietnam, Australia, China, Hong Kong, India, Japan, Korea, Macau, New Zealand, Sri Lanka, and Taiwan.

Travelers can purchase FlexiTravel Plus within 8 hours after departing Singapore, with a minimum coverage period of 24 hours. This post-departure option offers a new level of flexibility, ensuring travelers can secure coverage even after they’ve begun their journey, providing peace of mind for the remainder of their trip. For spontaneous travelers who may forget to buy insurance, this feature is especially valuable.

The cost starts at S$1.80 for six hours of coverage, with the option to extend at S$0.30 per additional hour, capped at S$3 per day. For instance, a 3-day, 2-night trip to Thailand would cost a maximum of S$9.

FlexiTravel Plus coverage can be activated, extended, or stopped anytime via the My Income mobile app, giving travelers the option to adjust their coverage if they return to Singapore earlier than expected.

Income Insurance has introduced FlexiTravel Plus, a new travel insurance option that allows travelers to extend their coverage by the hour for trips to 19 Asian destinations through the My Income mobile app. This policy replaces the previous FlexiTravel Hourly insurance, which only covered travel to Bintan, Batam, and Malaysia.

The 19 destinations now covered include Brunei, Cambodia, Indonesia (including Batam and Bintan), Laos, Malaysia, Myanmar, the Philippines, Thailand, Vietnam, Australia, China, Hong Kong, India, Japan, Korea, Macau, New Zealand, Sri Lanka, and Taiwan.

Travelers can purchase FlexiTravel Plus within 8 hours after departing Singapore, with a minimum coverage period of 24 hours. This post-departure option offers a new level of flexibility, ensuring travelers can secure coverage even after they’ve begun their journey, providing peace of mind for the remainder of their trip. For spontaneous travelers who may forget to buy insurance, this feature is especially valuable.

The cost starts at S$1.80 for six hours of coverage, with the option to extend at S$0.30 per additional hour, capped at S$3 per day. For instance, a 3-day, 2-night trip to Thailand would cost a maximum of S$9.

FlexiTravel Plus coverage can be activated, extended, or stopped anytime via the My Income mobile app, giving travelers the option to adjust their coverage if they return to Singapore earlier than expected.

Benefits | FlexiTravel Hourly Insurance (previous) | FlexiTravel Plus (new) | Income’s Travel Insurance (Classic per-trip plan) |

| Cancelling your trip | – | – | 5,000 |

| Postponing your trip | – | – | 2,000 |

| Shortening your trip | 1,000 | 3,000 | 5,000 |

| Trip disruption | – | 1,000 | 1,000 |

| Unused entertainment ticket | 200 | 400 | – |

| Travel alteration | – | 500 | – |

| Travel delay | – | 500 | 1,000 |

| Missed connections | – | 100 | 100 |

| Overbooked public transport | – | 100 | 100 |

| If the travel agency becomes insolvent | – | 1,000 | 2,000 |

| Baggage delay | – | 600 | 1,000 |

| Loss or damage of baggage and personal belongings | 1,500 | 1,500 | 3,000 |

| Losing money | 150 | 150 | 250 |

| Fraudulent use of bank card | 1,000 | 1,000 | – |

| Losing passport, driver’s license, and travel documents | 3,000 | 3,000 | 3,000 |

| Relief for additional transport expenses due to snatch theft, robbery or road accident | 50 | 50 | – |

| Personal accident | 50,000 | 150,000 | 150,000 |

| Medical expenses overseas | 50,000 | 200,000 | 250,000 |

| Medical expenses in Singapore | – | – | 12,500 |

| Treatment by a Chinese medicine practitioner or a chiropractor | – | – | 300 |

| Overseas hospital allowance | – | – | 10,000 |

| Emergency medical evacuation | 250,000 | 500,000 | 500,000 |

| Sending you home | 100,000 | 150,000 | 150,000 |

| Compassionate visit | 1,000 | 3,000 | 5,000 |

| Kidnap and hostage | 3,000 (100 per 24 hours) | 3,000 (100 per 24 hours) | 3,000 |

| Emergency phone charges | 100 | 100 | 100 |

| Home cover | – | – | 3,000 |

| Personal liability | 500,000 | 500,000 | 500,000 |

| Rental vehicle excess cover | – | – | 1,500 |

| Full terrorism cover | 50,000 | 150,000 | 150,000 |

| Automatic policy extension (days) | Not included | Not included | 14 |

| Post-departure purchase extension (*New) | Not included | Up to 8 hours after departing Singapore. Requires minimum 24 hours of coverage | Up to 2359hrs of the next day after departing Singapore |

Riders

| Optional Sports equipment cover | – | Overall limit 2,000 | Not available |

| Limit for loss or damage of sports equipment | – | 800 | Covered under main plan in Loss of baggage section, 500 per item |

| Limit for rental of replacement sports equipment per day | – | 100 per day | – |

| Limit for unused activity fees | – | 400 | – |