Manulife Singapore has launched Manulife SmartRetire (V), a whole-life regular premium, investment-linked insurance policy. Create a retirement plan best suited to your needs with premiums from S$300 per month. New policy owners would receive a welcome bonus and annual loyalty bonuses during the accumulation and retirement periods.

Choose to retire with a stream of income or to receive a lump sum from as early as 40 years old or even at age 70 based on their lifestyle needs.

“The pandemic has forced many of us to re-examine our finances, including our retirement plans. As busy Singaporeans prioritise making provisions for retirement, we wanted to offer a product that is easy to set up and flexible enough to cater for future adjustments. Manulife SmartRetire (V) is designed with this in mind, and we hope to support customers to build a comfortable retirement plan according to their lifestyle needs so they can retire with peace of mind,” said Darren Thompson, Chief Customer Officer and Chief Product Officer, Manulife Singapore

Manulife SmartRetire (V) Benefits

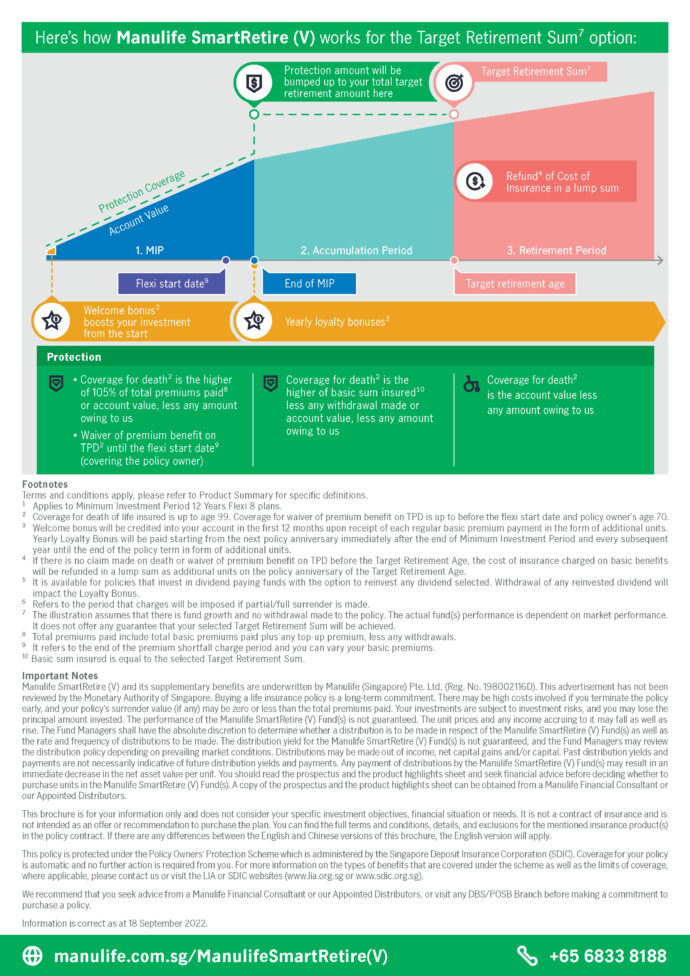

- Protection for total target retirement goal. The protection amount will be bumped up to the total target retirement amount during the accumulation period.

- Refund of Cost of Insurance. The cost of insurance changed during the term of the policy will be refunded if protection benefits are not utilised. If there is no claim made on death or waiver of premium benefit on TPD before the Target Retirement Age, the cost of insurance charged on basic benefits will be refunded in a lump sum as additional units on the policy anniversary of the Target Retirement Age.

- Coverage. Protection for death and waiver of premium benefit on Total and Permanent Disability. Coverage for the death of the life insured is up to age 99. Coverage for waiver of premium benefit on TPD is up to before the flexi start date and policy owner’s age 70.

- Bonuses. Get a boost to your investment with a Welcome Bonus from the start, and yearly Loyalty Bonuses during the accumulation and retirement periods. The welcome bonus will be credited into your account in the first 12 months upon receipt of each regular basic premium payment in the form of additional units. A yearly Loyalty Bonus will be paid starting from the next policy anniversary immediately after the end of the Minimum Investment Period and every subsequent year until the end of the policy term in form of additional units.

- Withdrawal Flexibility. Free withdrawal of reinvested dividends. It is available for policies that invest in dividend-paying funds with the option to reinvest any dividend selected. Withdrawal of any reinvested dividend will impact the Loyalty Bonus.

- Payment Options. Start from as low as S$300 per month via cash with a minimum investment period of 12 Years Flexi 8 plans.

Pingback: Empowering Women: Top Financial Services & Insurance Brands in Singapore | Consumer Finance Updates from Singlife and FWD | SUPERADRIANME.com