In the bustling metropolis of Singapore, the latest advancements in payments technology are transforming the way consumers experience transactions. Mastercard has introduced its innovative Click to Pay solution, seamlessly integrated at popular dining establishments such as The Marmalade Pantry, PastaMania, and Oriole Coffee+Bar through a partnership with Commonwealth Concepts. Meanwhile, JCB, in collaboration with iMago, has launched the “Chikazuite-Check” project, enhancing the shopping experience by simplifying processes like verifying age for alcohol and tobacco purchases or redeeming points and membership benefits. Across the globe, hospitality giant Accor has selected Stripe as its primary global payments partner, ensuring secure and efficient transactions for guests. As these technologies roll out, the landscape of consumer payments is poised for a significant evolution, prioritising convenience and ease like never before.

Mastercard Click to Pay debuts in Singapore at The Marmalade Pantry, PastaMania and Oriole Coffee+Bar

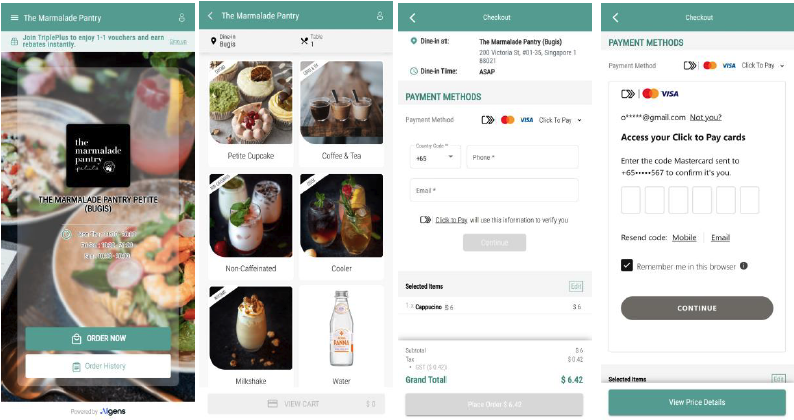

Mastercard has launched its Click to Pay solution through QR Pay by Link with Commonwealth Concepts, a food and beverage operator with over 15 distinct brands in Singpaore. The new payments solution has been rolled out to three of its brands – The Marmalade Pantry, PastaMania and Oriole Coffee + Bar.

Mastercard Click to Pay is a secure and convenient way to pay for meals without the need of a physical card or the hasle of manual card input for digital payments. Cardholders add their card details when they enrol for Mastercard Click to Pay. This payment information will be securely stored in their profile. Future checkouts will no longer require keying in passwords or card details again.

This seamless checkout experience will be powered by restaurant and hospitality technology partner Aigens. This solution leverages EMVCo’s Secure Remote Commerce specifications to ensure a standardised, secure and seamless checkout experience across all participating card schemes.

Diners can pay for their meals by scanning the QR code displayed by the merchant using their phone’s camera, wihtout the need for additional applications. QR Pay by Link is the gateway to Mastercard Click to Pay.

To celebrate this launch, Oriole Coffee + Bar will be offering a return voucher of a complimentary cup of coffee, when you pay by Mastercard Click to Pay until 2 August 2024. The Marmalade Pantry will offer a return complimentary coffee or tea voucher when you pay by Mastercard Click to Pay from 18 June to 16 August 2024. And PastaMania will be offering a return voucher of a complimentary plate of Crispy Chicken Fillet in July 2024.

Commonwealth Concepts is the first and only partner in Singapore who has integrated Mastercard Click to Pay. While this partnership focuses on F&B, Mastercard Click to Pay can be used across any industry or category from airlines to hotels to ecommerce. This solution can be enabled for any consumer purchases.

JCB & iMago launch “Chikazuite – Check” project to provide a new buying experience

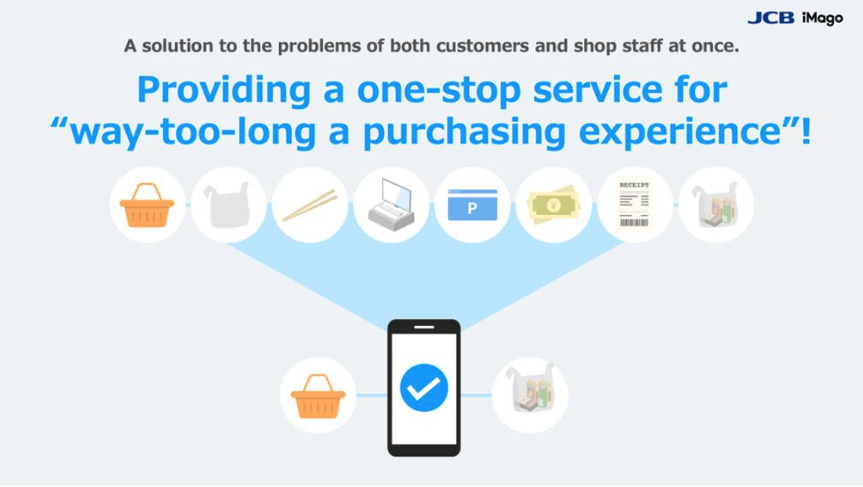

JCB and iMago have launched the “Chizakuite-Check” project to provide a new shopping experience using Ultra Wide band (UWB) and Bluetooth Low Energy (BLE). They have developed a prototype in Japan. An app for iPhone and Apple Watch that works with UWB/BLE together with a reference model of the store cash register system have been created for user testing.

“Chikazuite-Check” is a single-stop solution for your shopping experience. You can pre-register the details that will be asked at the checkout counter, such as payment methods, the ownership of point cards, age verification for alcohol and tobacco purchases, and whether or not you want a plastic bag, as “check items” on your smartphone app.

Consumers just need to download the smartphone app and enter the information which will be automatically sent to a store cash register device without the customer needing ot take out or use their smartphone.

The cash register device’s screen for the staff displays the customer’s pre-set check details, so they can make their purchases smoothly without verbal confirmation. The customer side screen is a touch panel, and present check details can be changed in real time immediately.

The smartphone app for customers and the store cash register screen that store staff can check are both available in multiple languages, creating a system that can reduce the communication costs due to the increase in both foreign customers and store staff.

Stripe to become Accor’s Primary Global Payments Partner

Hospitality company, Accor has picked Stripe, a financial infrastructure platform for businesses, as its primary payments partner globally. Accor plans to establish a comprehensive ecommerce platform offering a variety of services beyond rooms including spa services, restaurants, and even unique experiences. It wants to consolidate payments to simplify the booking process, and from an internal perspective, it needed to redistribute funds depending on the products and services selected by the guest.

Accor has been using multiple payment gateways with different providers. This move will allow Accor to implement a single centralised system across all its 40 hotel brands in 5,600 locations across over 110 countries for online bookings. Accor has benefited from a significant net conversion rate gain at the checkout step for prepaid bookings on its ecommerce channels compared to previous systems.

“Anyone who’s booked a hotel room knows the frustration when the payment doesn’t work as it should,” said Eileen O’Mara, chief revenue officer at Stripe. “Accor is putting guests at the heart of its payments experience. And we’re thrilled to play a part in its strategy which benefits both the hotels and their customers.”