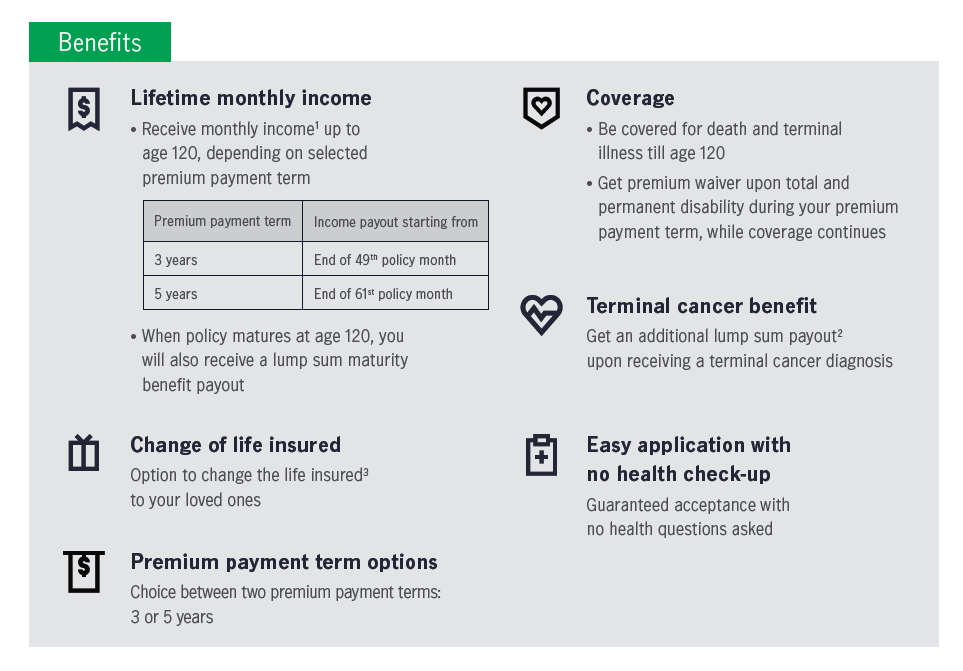

Manulife Singapore has enhanced its popular income-generating product, Manulife IncomeGen, responding to customer needs. Manulife IncomeGen (II) introduces a shorter breakeven period allowing customers to achieve capital guarantee by Year six with the ‘5-Pay’ version rather than the Year eight previously. There is also a new terminal cancer benefit that offers support following the terminal cancer diagnosis.

Manulife IncomeGen (II) caters to those who aspire to have income without working by giving them a lifetime- of monthly income payout, up to age 120 years

Income payouts under 5-Pay will start from the end of 61st policy month after policy inception and will continue until age 120 of the first policyowner (who is also the original life insured). To receive income payout up to age 120 of the original life insured, the original life insured can choose to transfer the policy to a family member, such as his or her child, as a gift for the child to continue receiving the income payouts. The new life insured would then be covered for death and terminal cancer.