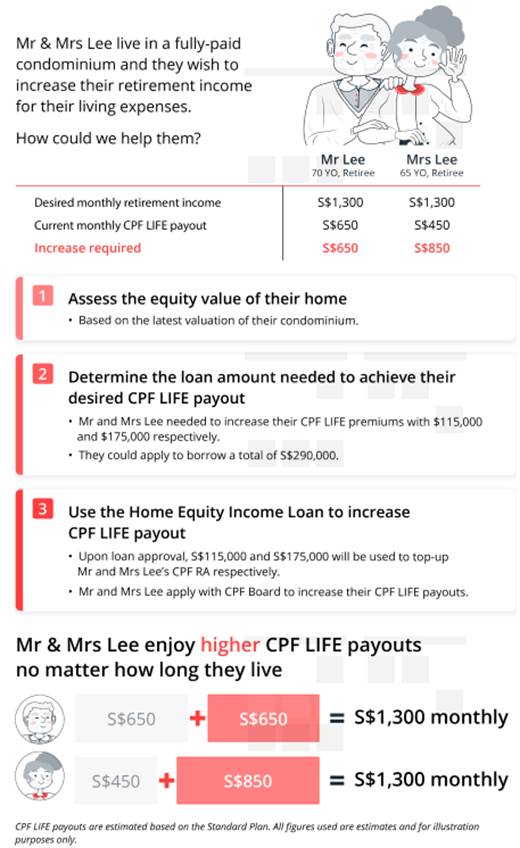

DBS launches the DBS Home Equity Income Loan, a market-first financing solution for seniors owning private property in Singapore. This pilot solution allows Singaporeans and Permanent Residents 65 to 79 years old to borrow against their fully-paid private residential property to top up their CPF Retirement Sums which will be used for the CPF LIFE scheme. This then allows them to receive monthly payouts to supplement their retirement funds for as long as they live. This is almost like the HDB scheme allowing home owners to pledge their HDB properties to receive higher CPF LIFE monthly payouts.

The CPF Lifelong Income for the Elderly (CPF LIFE) scheme is a national longevity insurance annuity scheme that provides Singapore citizens and permanent residents a monthly payout for as long as they live.

The DBS Home Equity Income Loan comes with a fixed rate of 2.88% per annum for up to a loan period of 30 years.

DBS Home Equity Income Loan Key Features

- Loan Period of up to 30 years till the customer or youngest borrower in the case of a joint loan reaches 95 years old

- Fixed interest rate of 2.88% per annum throughout the loan period

- No monthly loan repayments, with the loan amount and accrued interest payable only at loan maturity

- The long loan period also means that customers retain the flexibility to sell their property anytime if they so wish and to repay the loan without penalty fee.

Safeguards to Protect Borrowers’ Interest

- The maximum amount that can be borrowed will be limited to the amount required to top up the current CPF Enhanced Retirement Sum. This is S$279,000 in 2021.

- Borrowers need to set up a Lasting Power of Attorney if they do not have one. The borrower has to appoint one or more persons to make decisions and act on their behalf should they lose mental capacity.

- Should the value of the property decline during the loan period, borrowers are not required to make any payment to reduce the outstanding loan amount if there is no event which triggers early termination of the loan.

- DBS is committed to not repossess the property until after it exhausts all other mutually acceptable options with the borrower or their estate should there Ben an early termination of the loan. Such scenarios can include borrowers passing on during the loan period or if borrowers outlive the loan.

The current CPF Enhanced Retirement Sum is updated annually. The minimum loan amount would be the amount needed for borrowers to top up their CPF funds to meet the Full Retirement Sum for their cohort

Customers looking to decumulate their wealth can also consider another solution such as Schroder Asia More+, a multi-asset fund managed by Schroeder’s Singapore and distributed exclusively by DBS. Decumulation of wealth includes converting of savings, investments and other retirement benefits into sustainable income that can fund their needs and wants.