MoneySmart.sg conducted its annual Credit Card Survey in November 2016 polling 839 respondents between 21 and 39 years old who are current Singapore credit cardholders.

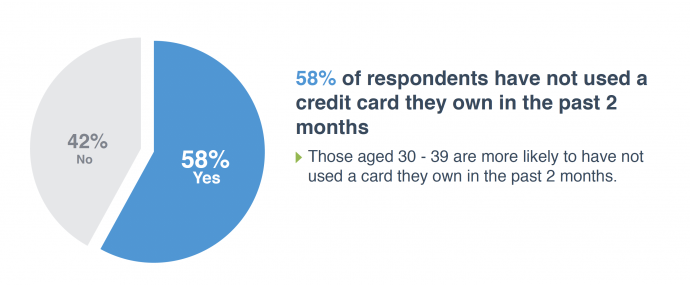

The number of credit cards owned per respondent declined from an average of five in the previous year to four. Vinod Nair, CEO of MoneySmart.sg shared that unsecured borrowing will decrease from 24 times to 18 times of one’s monthly income come June 2017. Probably one of the reasons, cardholders are cancelling under-utilised cards.

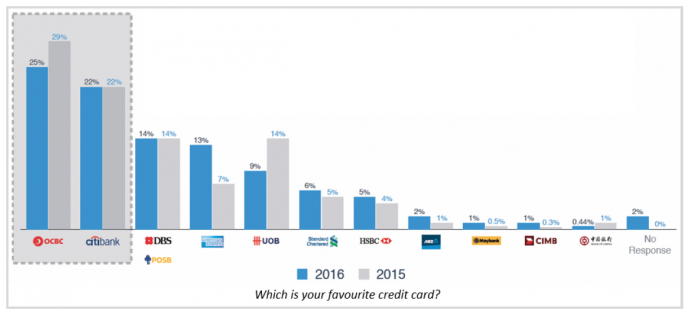

Three banks stood out in terms of top of mind recall, card ownership and preferred card providers with OCBC at 25%, Citibank 22% and DBS/POSB 14%.

American Express received the highest spike as a favourite credit card from 7% in 2015 to 13% in 2016, attributed to having the best customer service of 4.6 on a scale of 5, the most exclusive deals and benefits (3.71) and the best in ease of calculating and claiming benefits (4.4). 92% of respondents charging the most to the favourite credit card has reduced the need to have excessive cards.

Over 52% of respondents applied for their cards online. Roadshow booth applications are at a low 26% losing popularity amongst consumers.

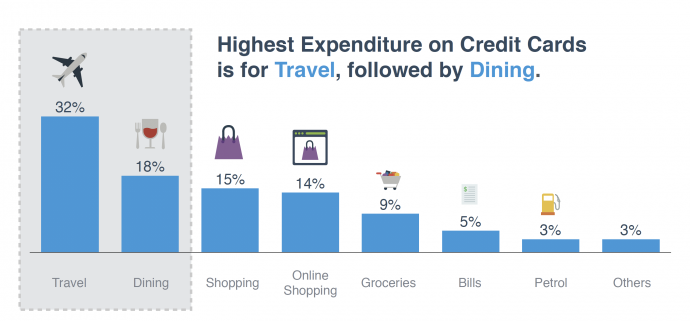

One-third of survey respondents spend the most money on their credit cards for travel expenditure followed by dining. That shouldn’t be hard to decipher. Travel expenditures tend to be a lot more expensive than dining. Singaporeans love to travel and get out and explore new experiences. We understand that last year, airlines experienced one of the lowest air fares ever, for a while.

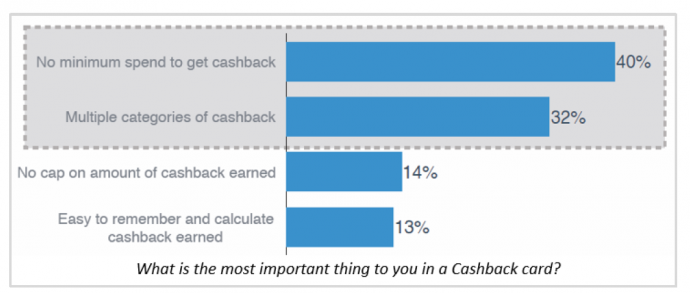

Cashback was the most preferred credit card benefit at 71% as opposed to Air Miles at 20%. It could be the instant gratification of cashback that allows consumers to benefit from their highest expenditure item be it for flights and hotel bookings or even groceries.

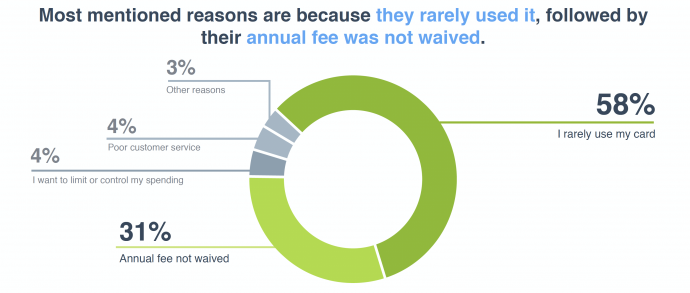

And for people cancelling credit cards. The main reason is because the card is rarely used followed by annual fees not getting waived. A very small percentage of 4% cancel their cards to limit or control their spending.