AXA Insurance Singapore has launched AXA SmartDrive, the latest car insurance product in Singapore that lets you customise the coverage to meet your needs based on your age group and lifestyle. Singapore is the Asian AXA entity to launch this new product. AXA understands that customers from various segments were looking for very different benefits and that everyone is different with unique and different needs.

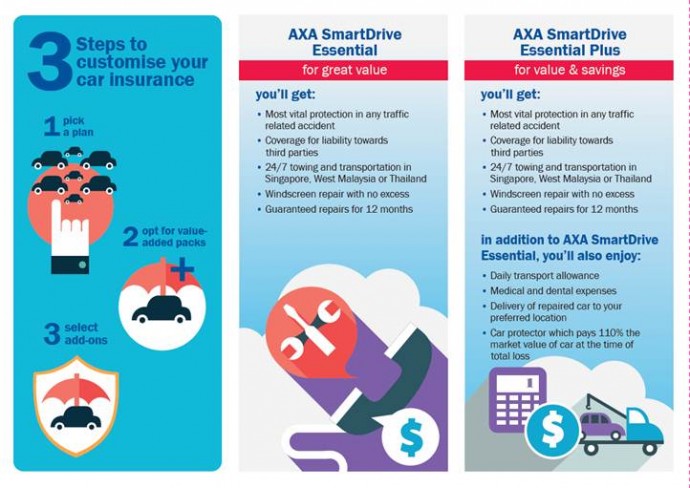

Enjoy the convenience of purchasing AXA SmartDrive online from www.axa.com.sg with three simple steps.

Step 1: Select a plan from a menu of seven different AXA SmartDrive plans

- AXA SmartDrive Essential – for great value

- AXA SmartDrive Essential Plus – For value and savings

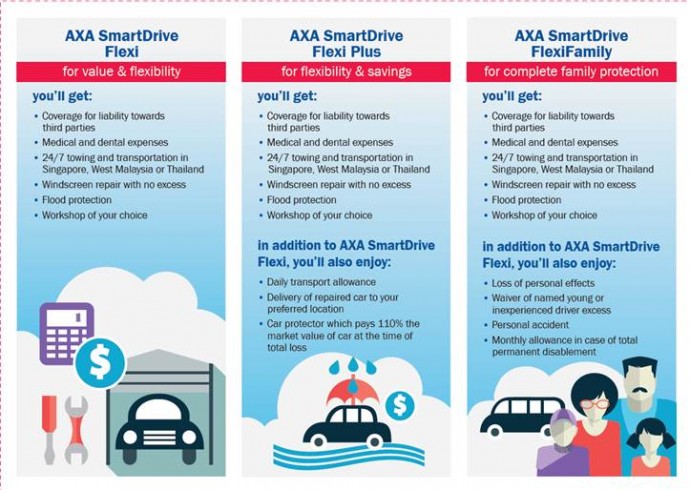

- AXA SmartDrive Flexi – for value and flexibility

- AXA SmartDrive Flexi Plus – for flexibility and savings

- AXA SmartDrive FlexiFamily – for complete family protection

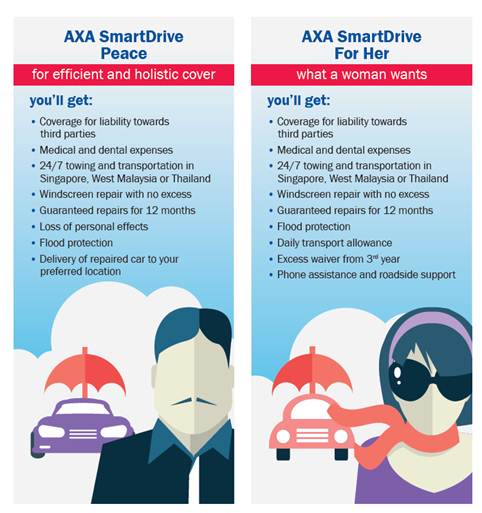

- AXA SmartDrive Peace – for efficient and holistic cover

- AXA SmartDrive For Her – offering what a woman wants

Step 2: Pick a Value-Added Pack (Optional)

There are five Value-Added Packs to pick from:

- Protector Plus (to minimise financial losses) – Offers daily transport allowance, delivery of repaired car, car protector that pays 110% the market value of car at the time of total loss and renewal premium discount.

- Duo Protector (one price for two drivers) – Offers daily transport allowance, medical and dental expenses, personal accident, monthly allowance in case of permanent disablement and excess reduction for duo.

- Claims Protector (to protect No Claim Discount [NCD] with excess waiver) – Offers excess waiver and NCD Protector

- Overseas Protector (for travellers) – Offers loss of personal effects, cancellation fees disbursement, hotel accommodation, overseas allowance and courtesy car overseas.

- Family Protector (for family protection in mind) – Offers medical and dental expenses, personal accident, loss of personal effects, waiver of named young or inexperienced driver excess and monthly allowance in case of permanent disablement.

Step 3: Pick any additional add-ons

- Excess Waiver – Waives basic own damage excess

- Excess Doubled – Double your own damage excess in exchange for a discount in your premium

- Courtesy Car in Singapore – Provided when your car is undergoing repair after an accident

- Personal Accident for Driver – You can choose sum insured of S$50,000, S$100,000, S$200,000 or S$500,000.

- Car Protector – Pays 110% the market value of car at time of total loss

- NCD Protector – Protect your NCD for all types of claims and accidents

- Car Accessories – Up to S$2,000 cover without affecting your NCD

- Phone Assistance and Roadside Support – Vehicle breakdown or immobilisation assistance

- Medical and Dental Expenses – Up to S$5,000 per person in an accident

- Personal Accident for Passengers – of up to S$20,000 in a car accident

- Monthly Allowance – Receive a monthly allowance in the event of a total permanent disablement from a car accident.

With three easy steps to pick from, buying insurance for your vehicle is now easier. There is no hassle in speaking to anyone, if you want to just purchase it at your own time without feeling pressured.

Check out photos of the launch below.